Balbowa Insights

Your source for the latest news and informative articles.

Crypto Cashouts: Where Your Wins Meet Instant Gratification

Unleash your crypto gains! Discover how to cash out your winnings instantly and experience the thrill of immediate rewards.

How to Effortlessly Cash Out Your Crypto Earnings: A Step-by-Step Guide

Cashing out your cryptocurrency earnings can seem overwhelming, but with a structured approach, it can be an effortless process. First, choose the right platform for converting your crypto into fiat currency. Popular exchanges like Coinbase, Binance, or Kraken offer user-friendly interfaces and competitive rates, making them ideal choices for beginners. Once you've selected your exchange, create an account, and complete the necessary verification steps to ensure compliance with regulations. This may involve providing identification documents and linking your bank account for transfers.

After setting up your account, the next step is to transfer your crypto funds to the exchange. Navigate to your wallet where your cryptocurrency is stored, and select the option to withdraw or send funds. Be sure to enter the correct wallet address of your exchange account to avoid any loss of funds. Once the transfer is complete, go to the trading section of the exchange and select the option to sell your crypto for your desired fiat currency. Confirm the transaction, and within a few hours, your cash will be available in your bank account, completing your effortless cash-out process.

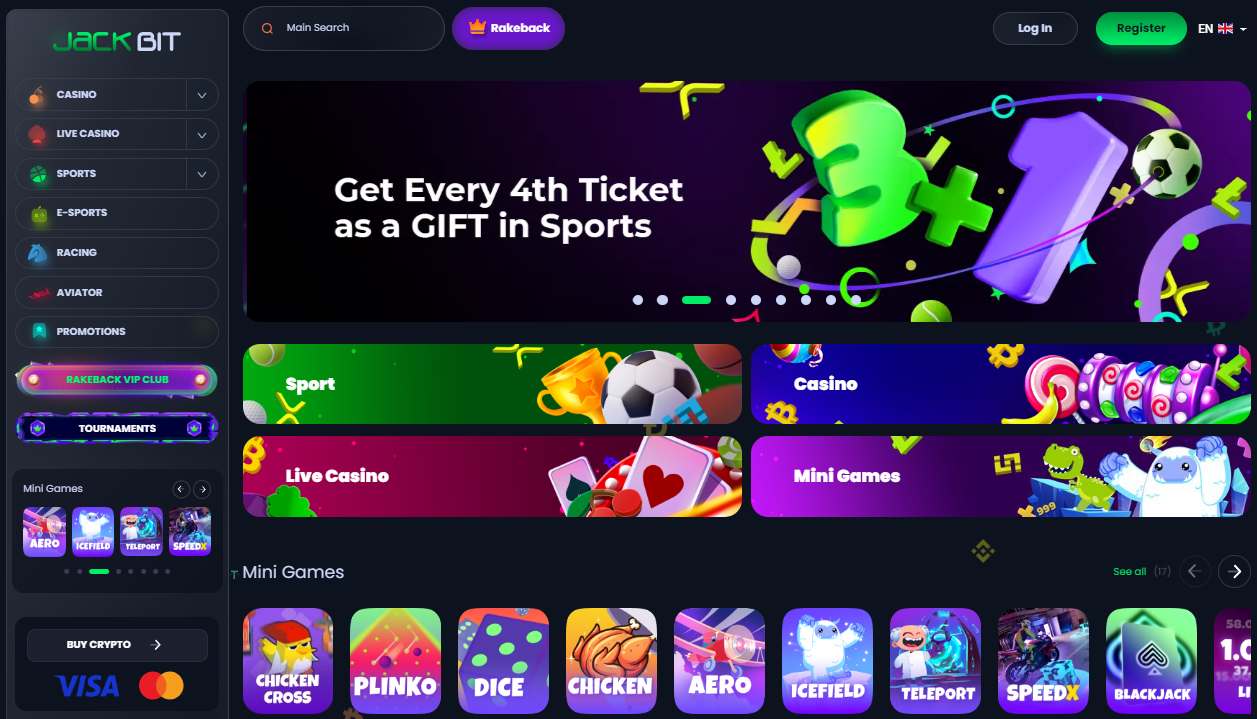

As the online gambling industry continues to evolve, many players are turning to a crypto casino for their gaming needs. These platforms offer the excitement of traditional casinos, combined with the advantages of cryptocurrency, such as faster transactions and enhanced security. With a growing selection of games and promotions, the appeal of crypto casinos is undeniable.

Understanding the Best Platforms for Instant Crypto Cashouts

In the rapidly evolving world of cryptocurrency, instant cashouts are a vital feature for traders and investors alike. Various platforms have emerged, each offering unique functionalities for converting digital assets back into fiat currency within moments. When considering the best platforms for instant crypto cashouts, it’s essential to evaluate factors such as fees, user interface, and supported currencies. Some popular platforms include Coinbase, known for its user-friendly interface and high liquidity, and Binance, which offers low transaction fees and a vast selection of cryptocurrencies.

Beyond basic functions, the selection of a platform for instant cashouts should also take into account security measures and customer support. Look for platforms that provide two-factor authentication (2FA) and are insured against breaches. Additionally, read user reviews to gauge the effectiveness of their customer support during cashout processes. By carefully analyzing these components, you can choose a suitable platform that not only fulfills your need for instant crypto cashouts but also ensures a secure and efficient trading experience.

What You Need to Know About Taxes When Cashing Out Your Cryptocurrency

When you decide to cash out your cryptocurrency, it's essential to understand the tax implications that come with this financial decision. The Internal Revenue Service (IRS) classifies cryptocurrencies as property, meaning that cashing out may result in capital gains or losses. Cashing out refers to converting your digital assets into fiat currency, and any profit made since you purchased the cryptocurrency will be subject to capital gains tax. It's crucial to keep detailed records of your purchase prices, sale prices, and holding periods to accurately report your gains or losses when filing your taxes.

Furthermore, it’s important to recognize that taxes on cryptocurrency can be complex. Depending on how long you held the asset, the capital gains tax rate can vary significantly. If you held the cryptocurrency for longer than one year before cashing out, it qualifies for long-term capital gains, which tend to be lower than short-term rates. Additionally, any losses incurred can potentially offset other taxable gains, offering you some relief when tax season arrives. Always consider consulting a tax professional who is knowledgeable about cryptocurrency regulations to ensure compliance and maximize your tax efficiency.